Transfer pricing expert

- Over ten years experience

- Advice in English and German

- Short-notice appointments possible

Setting compliant transfer prices

Together for your transfer pricing compliance

- competent.

- reliable.

- practical.

Your tax and transfer pricing experts

Transfer pricing advice from Berlin

Your tax and transfer pricing experts

Verrechnungspreisberatung für den Mittelstand

Transfer pricing is an increasingly important issue for many companies. With our many years of experience in tax and transfer pricing advice, we would like to help you to organise your transfer pricing in a practical and effective manner at an early stage. We help you to manage transfer pricing in a legally compliant manner and to prepare for the extensive national and international compliance requirements at an early stage.

Our expertise and experience can help you navigate the complexities of transfer pricing rules. We can put your supply and service relationships on a practicable basis that is consistent with the arm's length principle and your desired business model.

Our contribution to your transfer pricing compliance

Our services

We are here for you

Team

For more than ten years, we have been advising medium-sized and multinational companies in a wide range of industries on the selection, implementation and defence of arm's length transfer pricing. In addition to transfer pricing expertise, the team has decades of experience in sustainable tax structuring and compliance requirements. Our diverse experience with a wide range of clients ensures the quality of our advice.

Lorenz

Kurrek

Als Verrechnungspreisexperte mit Erfahrung auf Berater- und Unternehmensseite helfe ich Unternehmen, ihre Verrechnungspreisstrukturen fremdüblich und praxisnah zu gestalten.

I can help you translate the complexity of transfer pricing requirements into clear and sustainable structures.Jeffrey

Buder

Thomas

Buder

As a certified tax advisor and former tax auditor, I know both sides of the coin: the tax administration and the taxpayer.

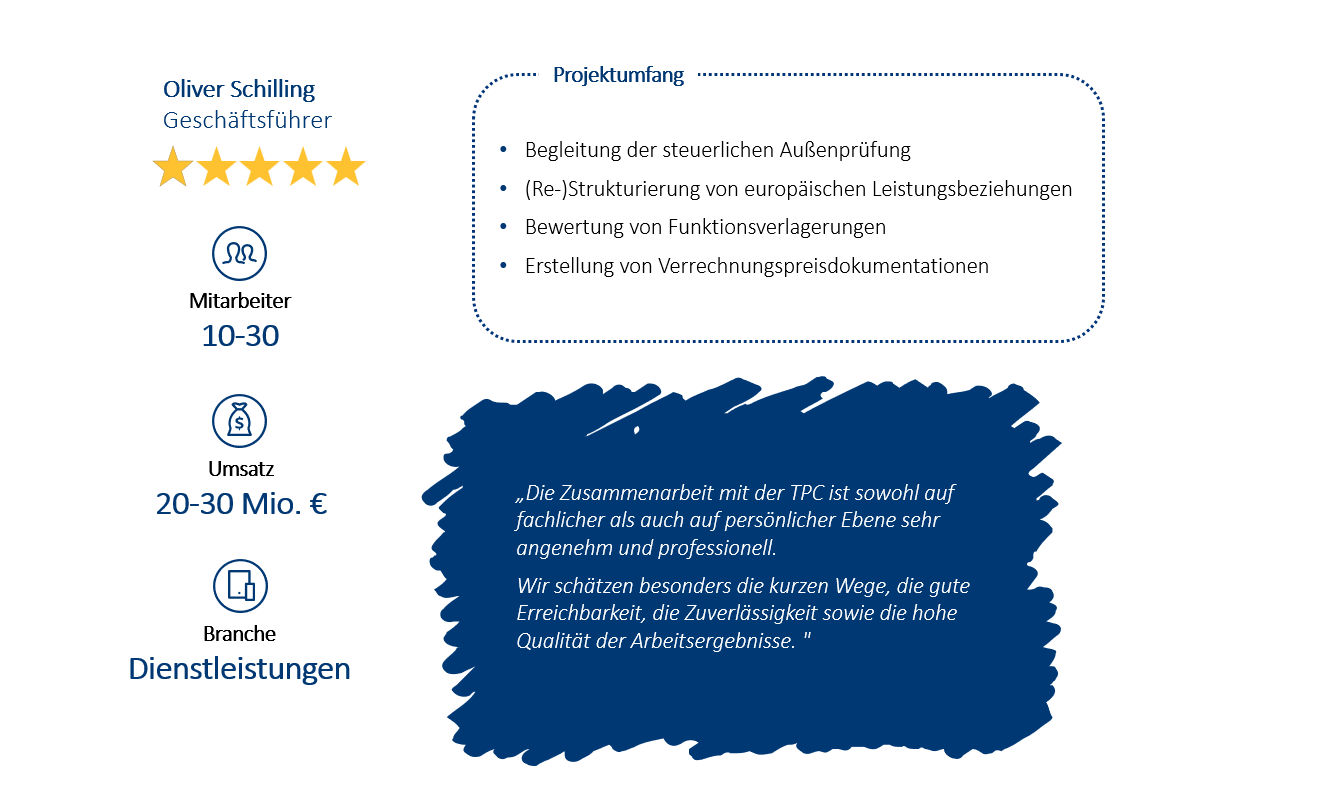

I bring around 30 years of experience from both worlds to help you secure tax-efficient structures for the long term.Das sagen unsere Kunden & Partner über uns

References

You ask - We answer

FAQ

What are transfer prices?

Transfer prices (also known as transfer pricing) are the prices at which goods, services and intangible assets within a group or company are charged between related companies or business units across national borders. These prices play an important role in multinational companies with different subsidiaries or business units in different countries.

The determination of transfer prices is important for the calculation of profits and losses in the different business units of a multinational enterprise. It also has an impact on taxation, as different countries may apply different tax rates and the allocation of profits in different countries (may) depend on the transfer prices chosen.

For transfer prices to be internationally recognised, they must comply with the arm's length principle. This means that transfer prices must be set as they would have been agreed between independent market participants - for example, in a free market. Transfer pricing is a complex process that is subject to increasingly stringent rules and regulations to ensure that transfer prices are set fairly and are not used to artificially shift profits in order to save tax. Many countries have specific transfer pricing rules and requirements, and companies need to ensure that their practices comply with the applicable rules.

For whom is transfer pricing relevant?

Transfer pricing is one of the key tax and business challenges for international companies. Tax rules on transfer pricing are becoming increasingly important as multinational groups determine their intercompany pricing arrangements globally. Increasing documentation requirements, greater transparency and stricter sanctions mean that transfer pricing structures and documentation need to be reviewed and controlled on a regular basis. A tailored transfer pricing strategy and its effective implementation in accordance with the arm's length principle are therefore essential for international companies with cross-border supply and service relationships. This is particularly true if your company is integrating additional foreign entities, seeking to adapt its business model, or if (inter)national transfer pricing rules change.

What are the consequences of incorrectly set transfer prices?

Inaccurate transfer pricing can have a number of consequences, particularly in relation to the taxation and financial performance of companies. Some of the possible consequences are listed below:

Tax consequences: Incorrect transfer pricing can lead to significant tax problems. If the tax authorities consider that transfer prices are not at arm's length (i.e. the prices that would have been agreed between independent third parties), they can reallocate profits and unilaterally adjust the tax burden in the countries concerned. This can lead to additional payments, penalties and an increased risk of tax audits. At the same time, it can result in a double tax burden without a corresponding adjustment of taxation in other countries.

Operational problems: Incorrect transfer pricing can also cause operational problems within a company. For example, incorrectly calculated costs can affect the profitability of a business unit or lead to an inefficient allocation of resources.

International conflicts: In multinational companies, incorrectly set transfer prices can lead to tensions between subsidiaries, especially if certain units feel disadvantaged or if the whole organisation comes under pressure because of tax problems.

Reputational damage: Inappropriate transfer pricing can also damage a company's image and reputation. At a time when transparency and corporate governance are becoming increasingly important, inappropriate transfer pricing may be perceived as unethical or unacceptable, leading to a loss of confidence among investors, customers and other stakeholders.

It is therefore vital that companies take great care when setting transfer prices and ensure that their practices comply with the applicable rules. Professional tax advice and compliance with international standards can help minimise these risks.

What is compliance in the context of transfer pricing?

Transfer pricing compliance refers to the adherence to all relevant legal and regulatory requirements when companies set transfer prices, especially in multinational groups. The objective of transfer pricing compliance is to ensure that transfer prices between related parties are consistent with tax rules and the arm's length principle.

Some aspects of transfer pricing compliance are described below:

Arm's length principle: The basis for transfer pricing compliance is the arm's length principle. This states that the terms, conditions and prices of cross-border transactions between associated enterprises should be substantially the same as those that would have been agreed between independent, unrelated enterprises. Companies must be able to demonstrate that their transfer prices comply with this principle.

Documentation requirements: Many countries require companies to prepare and maintain comprehensive documentation of their transfer pricing. The purpose of this documentation is to provide local tax authorities with the information they need to assess the appropriateness of transfer prices. The nature and extent of the documentation required may vary from country to country.

Consistency and transparency: Consistency and transparency are key. Companies should ensure that their transfer pricing is consistent across all business units and across different transactions of the same transaction type. In addition, management should establish transparent and clear transfer pricing policies.

Compliance with local regulations: As transfer pricing involves cross-border activities, companies must be fully aware of and comply with the specific transfer pricing rules in the countries in which they operate. This often requires close collaboration with tax and legal advisors.

Risk management: Companies should implement risk management processes to ensure that transfer pricing strategies comply with tax requirements and thus protect the company from potential tax risks. This may include regular transfer pricing reviews, staff training and the establishment of internal controls.

Compliance with these principles is important to avoid legal disputes, tax risks and reputational damage. Companies should regularly review their transfer pricing policies and ensure that they comply with changing tax and regulatory requirements.

What are the advantages of transfer pricing compliance?

Transfer pricing compliance offers companies a number of benefits, both financial and operational. Some of the main benefits are:

Avoidance of tax risks: Transfer pricing compliance helps to minimise potential tax risks. By setting transfer prices that are consistent with the arm's length principle, companies can ensure that their transactions are tax compliant and less likely to result in subsequent income adjustments and penalties during tax audits.

Strategic planning and budgeting: A clear and consistent transfer pricing policy enables better strategic planning and budgeting. Companies can better align their business strategies by ensuring that transfer pricing is aligned with business objectives and tax requirements.

Cost efficiency: By complying with transfer pricing rules, companies can avoid the potential costs of litigation, penalties and additional tax payments. This contributes to the financial stability and cost efficiency of the business.

Efficient risk management: Companies can implement effective risk management through compliance measures. This includes the identification, assessment and control of transfer pricing risks. A systematic approach to risk avoidance or minimisation can ensure the financial stability of the enterprise.

Reputation and trust: Transfer pricing compliance helps protect a company's reputation and trust. A transparent and ethical approach to transfer pricing can strengthen the confidence of investors, customers, employees and other stakeholders.

Overall, transfer pricing compliance not only helps to minimise risk, but can also ensure a company's long-term sustainability and competitiveness.

Can I stay with my current tax advisor?

Yes, we are happy to work together with your existing tax advisor and complement them in terms of content.

As businesses expand across national borders, issues such as international tax and transfer pricing often become relevant. This regularly leads to an increased need for advice. Due to a lack of specialisation, this cannot usually be covered by the existing tax advisor. This is not a reflection on the quality of the advice provided by the existing tax advisor, but is due to the fact that these are extensive areas of specialisation. They are usually provided by tax specialists in the market. The rules and requirements in the area of transfer pricing are very complex and are constantly evolving. In addition, good transfer pricing advice requires your advisor to have extensive market experience. For this reason, and in order not to jeopardise the existing relationship of trust with your tax advisor, we are happy to support you.

Together with your existing tax advisor, we ensure that you are legally compliant in the international tax environment and can concentrate fully on your business. After all, 'tax follows business' and expanding across national borders is a great step for you and your business!

This success needs to be secured in the long term by structuring the tax system in a legally compliant manner and by adhering to compliance requirements.

Always at your service

Contact

We will be happy to advise you on your questions about transfer pricing.

Give us a call and let us advise you directly or send us an email and we will get back to you shortly.

We look forward to hearing from you!

Kurfürstendamm 14, 10719 Berlin, Germany

+49 30 288 88 123

office@tp-compliance.de

Contact form

The fields marked with an * are mandatory fields.

Developments in the tax and transfer pricing environment

Beiträge

In unserem Verrechnungspreis-ABC stellen wir für jeden Buchstaben verschiedene Verrechnungspreisthemen vor.

In diesem Beitrag die Buchstaben V bis XIn unserem Verrechnungspreis-ABC stellen wir für jeden Buchstaben verschiedene Verrechnungspreisthemen vor.

In diesem Beitrag die Buchstaben S bis UIn unserem Verrechnungspreis-ABC stellen wir für jeden Buchstaben verschiedene Verrechnungspreisthemen vor.

In diesem Beitrag die Buchstaben P bis RIn unserem Verrechnungspreis-ABC stellen wir für jeden Buchstaben verschiedene Verrechnungspreisthemen vor.

In diesem Beitrag die Buchstaben M bis OIn unserem Verrechnungspreis-ABC stellen wir für jeden Buchstaben verschiedene Verrechnungspreisthemen vor.

In diesem Beitrag die Buchstaben J bis LIn unserem Verrechnungspreis-ABC stellen wir für jeden Buchstaben verschiedene Verrechnungspreisthemen vor.

In diesem Beitrag die Buchstaben G bis IIn unserem Verrechnungspreis-ABC stellen wir für jeden Buchstaben verschiedene Verrechnungspreisthemen vor.

In diesem Beitrag die Buchstaben D bis FIn unserem Verrechnungspreis-ABC stellen wir für jeden Buchstaben verschiedene Verrechnungspreisthemen vor.

In diesem Beitrag die Buchstaben A bis C